buy and build private equity

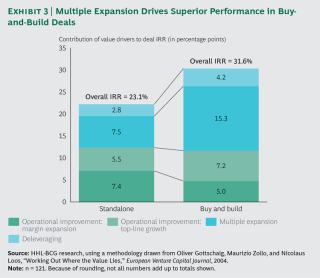

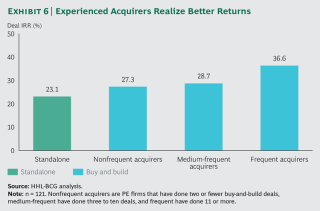

PE firms in the sample with more than ten buy-and-build deals under their belts earned an average IRR of 366 compared with 273 for firms with fewer than two buy-and. I then set out to find a private equity partner to pursue a buy-and-build strategy with the goal of building a 300-500 million adhesives sealants business through a very disciplined MA.

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Private Equity Explained With Examples And Ways To Invest

The firm has come a long way since its.

. A sector with room to run Sector dynamics can have a huge impact on the success or failure of. A buy-and-build consultant is a professional that sources investment and acquisition possibilities for private equity firms consulting companies acquiring companies and individual investors. Buy build strategies in private equity are where a PE house invests in a well-positioned platform company and looks to add value to that company through carefully executed additional.

If youre looking to carry out a business acquisition or continue a buy and build strategy private equity can help. Private equity PE groups have bid up freight brokerage EBITDA multiples to low to mid double-digits 12-14x making it hard for strategic buyers ie. Find lifestyle inflection points and accelerate company growth through buy and build.

When investors put their funds into private. The most effective buy-and-build strategies share several important characteristics. Growth by business acquisition.

Investors have piled into. The buy and build strategy is common among private equity firms with a short holding period of between three and five years. The firms underlying investment thesis.

LDCs financial investment and MA expertise. Private equity firms generally use this strategy more often than anyone else but it is also used by strategic buyers publicly traded companies and closely held businesses. Buy-and-build transactions in which a private equity firm acquires a company and then builds onto it through add-on acquisitions generate superior internal rates of return IRR.

NTG founded in Atlanta in 2005 received its first private equity backing in September 2016 in the form of 245 million of development capital from Ridgemont Equity. The buy-and-build framework is one where a big platform company is acquired followed by a series of small add-on acquisitions in the same sector to build a larger company.

Buy And Build A Powerful Pe Strategy But Hard To Pull Off Bain Company

Size And Focus Both Necessary For This Buy And Build Private Equity Investor Intrafish

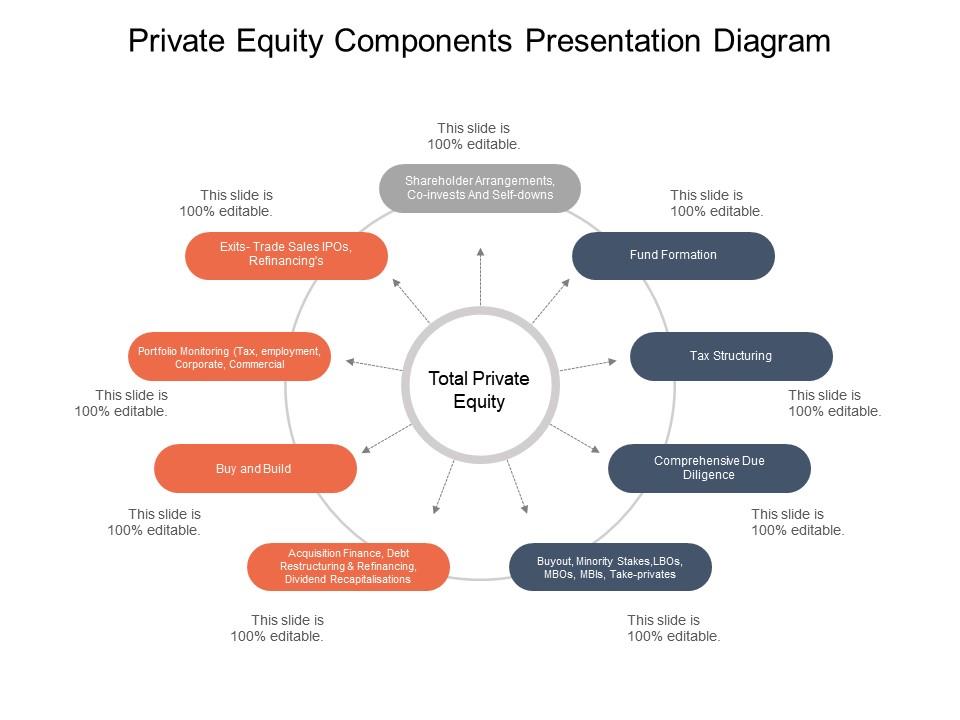

Private Equity Components Presentation Diagram Powerpoint Graphics Powerpoint Slide Images Ppt Design Templates Presentation Visual Aids

Overlay Real Time Portco Visibility For Private Equity

Buy And Build A Powerful Pe Strategy But Hard To Pull Off Bain Company

Fresh Profile Agi Partners And Its Buy And Build Strategy Buyouts

How Private Equity Firms Fuel Next Level Value Creation

Audax Private Equity Invest In Thermogenics Citybiz

Private Equity The Power Of Buy And Build Portfolio For The Future Caia

Pe Pursues Buy And Build Marquette Associates

What Private Equity Can Learn From Entrepreneurs Buy Then Build

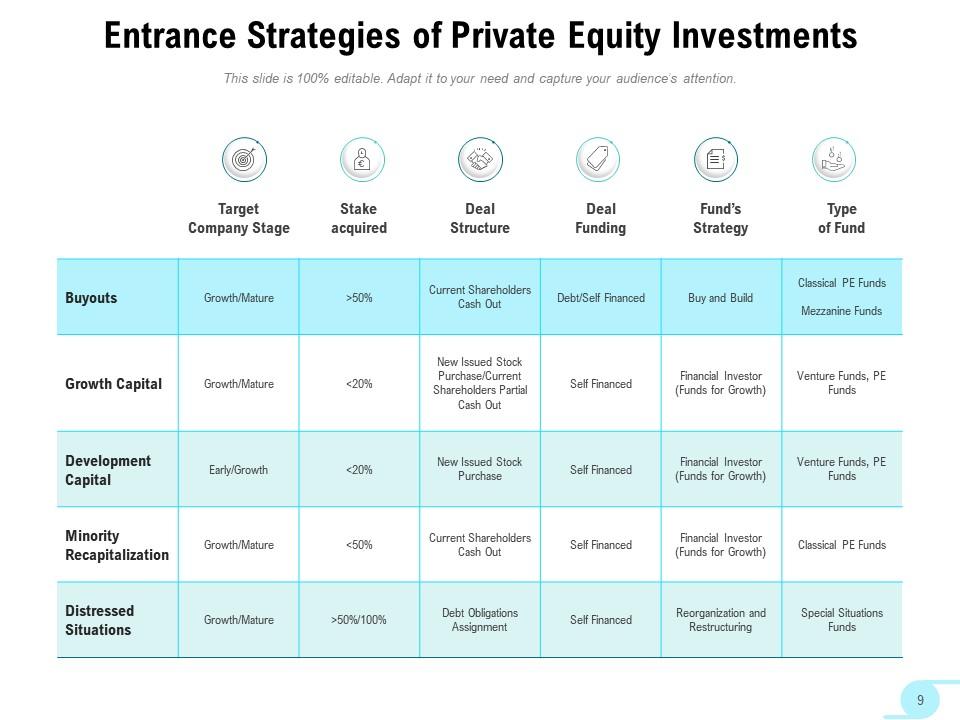

Private Equity Strategies Investors Growth Business Framework Success Investment Structure Presentation Graphics Presentation Powerpoint Example Slide Templates

Overview Of Private Equity B A Corporate Advisors

Private Equity And The New Science Of Growth

How Private Equity Firms Fuel Next Level Value Creation

/cloudfront-us-east-1.images.arcpublishing.com/dmn/7DMIETDCTZCAFFT6P5BR2ETBZE.jpg)

Two Dallas Private Equity Firms Close Buy And Build Deals In Health Care Specialties

Pdf Private Equity And The Buy And Build Strategy Cultural Challenges With Cross Border Semantic Scholar

Ahead Of The Curve Private Equity Shift To Buy And Build Strategy